The US Dollar Index (USDX), which measures the dollar’s strength against a basket of foreign currencies, is showing signs of weakness as a range of economic and geopolitical pressures weigh heavily on the greenback. The dollar’s struggle against major global currencies signals a distinct vulnerability and softness in the US economy.

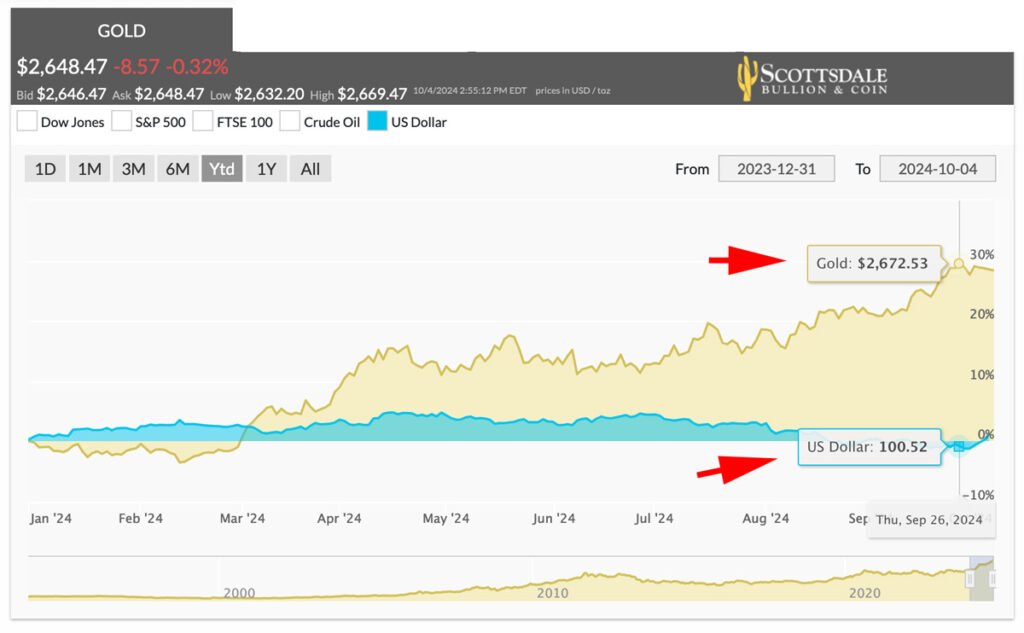

At the same time, gold continues its record-breaking ascent. The yellow metal is sitting near all-time highs of around $2,700/oz. This simultaneous weakening of the dollar and surge in gold reflects a broader economic shift, as investors move away from dollar-backed assets, driving up demand for safe-haven assets such as gold.

A Strong Start for USD & Gold

Throughout the first half of 2024, the dollar and gold showed signs of strength. Both the stock market and the yellow metal notched several records. However, these typically inverse assets climbed for different reasons. The dollar’s strength stemmed from the lingering effects of easy-money policies that pumped liquidity into the economy, encouraging people to invest. Meanwhile, gold’s rise foreshadowed the challenges ahead as record-high central bank demand elevated prices.

Fed Rate Cut Marks the Shift

The Federal Reserve’s recent 50-basis point rate cut marked a pivotal moment, creating a clear divergence between the dollar and gold. This relatively aggressive cut signals the beginning of a period of quantitative easing. Typically, investors abandon dollar-linked assets in a lower-interest-rate climate as yields drop, favoring the relative stability of safe-haven assets such as gold.

Following the Fed’s rate slash, the USDX dropped to its lowest point in 2024, suggesting that investor confidence in the dollar is already waning.

Gold’s response to the Fed’s rate cut was dramatic, surging past the $2,600 mark. This sharp rise signals that the rate cut acted as a tailwind for already soaring gold prices.

Challenges to USD Value

The greenback faces a slew of obstacles moving forward which affect its price stability, overall value, and attractiveness:

De-Dollarization – One of the strongest threats to the dollar’s dominance is de-dollarization, spearheaded by the BRICS nations. This consortium of emerging economies is actively reducing their reliance on the dollar. In this vacuum, countries like China and Russia are pushing to elevate their own currencies, directly challenging the dollar’s global supremacy.

National Debt – The US economy is burdened by a $35 trillion national debt, which is a ticking time bomb for the dollar’s value. The rapidly rising costs of servicing the debt call into question the government’s ability to manage it and undermine global confidence in the stability of the greenback.

Political Instability – Historically, presidential elections bring volatility to the dollar, as potential policy shifts can impact its value. The upcoming election, being one of the most contentious in recent memory, could exacerbate this choppiness. Increased domestic political instability makes the dollar less appealing to investors, adding to the risks of a weakened currency.

Gold’s Surge Continues

In 2024, gold prices have been on an unprecedented run, constantly setting new records. Each time investors celebrate a milestone, the yellow metal breaks through to another high. Currently, gold stands around $2,700, following a significant boost after the Federal Reserve’s aggressive rate cut. Since the start of the year, gold has surged by an impressive 27%, outperforming dollar-linked assets like the stock market. Because gold and the dollar tend to move in opposite directions, any weakness in the USD acts as a bullish signal for gold, pointing to further price gains ahead.

What’s Next?

The trend of rising gold prices alongside a devaluing US dollar is anticipated to persist. Despite an already impressive rally, experts are raising their gold price predictions, reflecting growing confidence in gold as a safe-haven asset. The dollar is facing pressure in the near term due to a low-interest rate environment created by the Fed’s rate cuts.

In the long run, the dollar is also struggling to maintain its status as the world’s reserve currency, which has historically helped preserve its value.