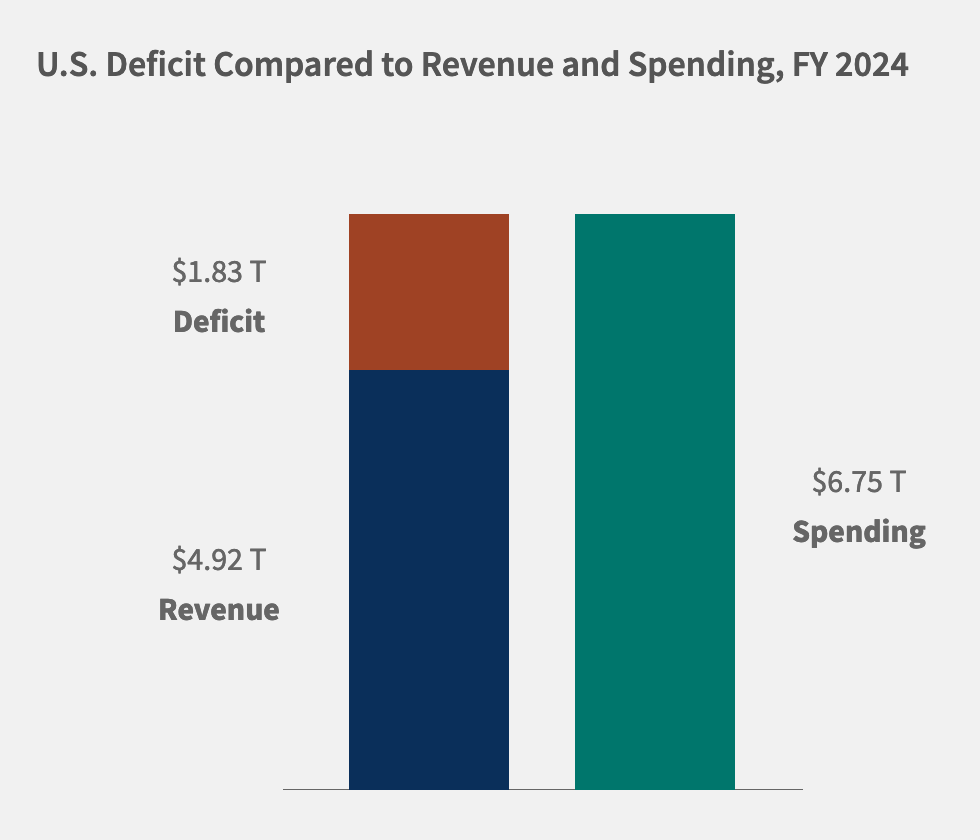

The federal deficit reached a startling $1.8 trillion, barely a month into the fourth quarter of 2024. This 8% increase from last year’s losses highlights the nation’s exponentially rising budget. As the main contributor to national debt, a growing deficit prevents larger problems from being solved. At the same time, the cost of servicing the debt blew past the $1 trillion mark for the first time in history.

Crunching the Numbers

- The 2024 deficit stands at $1.8 trillion and could easily top $2 trillion by EOY.

- Interest rate payments on national debt have reached a record of $1.16 trillion.

- The national debt has swelled by $2.3 trillion since the end of 2023.

- The past two administrations have collectively added over $12 trillion to the debt.

- The US has only cleared a budget surplus four times in the past 50 years.

- The deficit accounts for 6% of the total economy, nearly double the average of 3.7% for the past 50 years.

State of US Deficit

The towering $35 national debt often blocks progress in addressing the crucial deficit conversation. After all, fixing net annual expenditures is foundational to climbing out of the debt hole. Tragically, these recent numbers suggest the government is only digging the country deeper. This year’s deficit hit $1.8 trillion barely a month into the fourth quarter, marking an 8% jump from last year’s levels.

Debt Costs Skyrocket

The deficit isn’t the only debt-related issue that has hit a new high. Thus far in 2024, interest rate payments have climbed to a new peak of $1.16 trillion, the first time costs have reached beyond the trillion-dollar mark. In 2024, 2.97% was the average interest rate on debt. That crucial number increased to an average of 3.32% this year. As interest costs cross over the $1 trillion line and rates continue to soar, the government’s response seems increasingly inadequate, leading many investors to wonder if the problem will ever get solved.

No “Soft Landing” in Sight

Many investors were hoping interest rate cuts would usher in a period of economic stability and strength. After all, the Fed had insisted on a “soft landing” for years and even achieved that goal, according to their own standards. Unfortunately, our economic problems run deeper than rate changes can solve.

Aggressive rate cuts within a short time, such as the half-point reduction initiated last month, tend to hurt the dollar. Periods of quantitative easing often bring down stocks, bonds, and other dollar-linked assets with it. A weaker dollar also makes debt payments more burdensome by lowering the greenback’s buying power and hampering economic growth. This further compounds the fact that debt servicing has been growing exponentially.

Investors Turn to Gold

With no concrete solutions from the government, investors are starting to take matters into their own hands. The booming debt bubble and blown federal budgets are resulting in a large-scale transition into safe-haven assets. There’s no clearer indication of this shift than the staggering gold demand from central banks which have been scooping up gold in record rates for years.

Retail investors are now following suit with major financial institutions such as Bank of America and Goldman Sachs calling for people to protect their wealth with the yellow metal.

“Trusting the Federal Reserve to be able to make the changes to help is a bad strategy. People need to safeguard their assets so they don’t lose them in the coming financial problems.”– Todd Graf, Precious Metals Advisor at Scottsdale Bullion & Coin