Silver prices have surged to their highest point since 2012, fueled by gold’s record-setting rally. More specifically, a combination of waning economic conditions, declining investor confidence, and favorable market conditions have propelled the white metal upward. Last week, silver prices climbed to a recent peak of $32.71, extending its 2024 gains to an impressive 37%. This stellar performance puts silver ahead of the stock market and gold for this year. Following these fresh highs, experts are predicting further price growth.

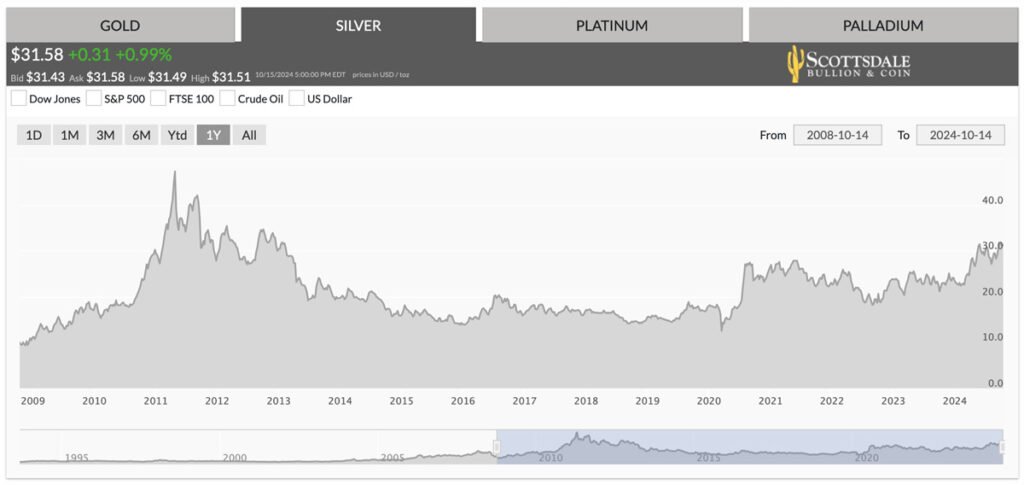

Silver Lands 12-Year High

Silver prices aren’t in unfamiliar territory. In fact, the shiny metal nearly reached $50 per ounce in 2011. This relative peak followed the aftermath of the 2008 financial crisis which sparked a transition into safe-haven assets like precious metals. Now, over a decade later, silver has clawed back most of those previous gains.

It’s not just the price action that looks familiar. The economic landscape mirrors the post-housing bubble era. Today’s stalled economy, rising national debt, and weakened dollar in the wake of the pandemic ear are pushing investors to seek refuge in more stable investments, driving silver prices higher.

Silver Outperforms Stocks & Gold

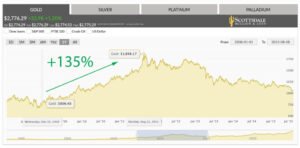

Gold has been hogging the spotlight following its sustained rally. However, silver prices have actually outperformed its more popular cousin in 2024. So far, silver prices have jumped 37% compared to gold’s respectable 27% gain. Of course, silver’s rise appears larger partly because of its lower price point compared to gold, making its percentage increase more pronounced. This reality is compounded by the fact that silver’s smaller market size contributes to more volatile price action. However, these variables don’t overshadow the fact that silver is currently one of the strongest-performing assets available to investors.

What’s Driving the Surge?

Rate Cuts – Both silver and gold prices experienced a boost from the Federal Reserve’s swooping rate cut. With lower interest rates, investors often decrease their exposure to the dollar in favor of alternative investments such as silver and gold. This shifting focus further boosts precious metal prices.

Gold Rally – As the most widely traded and most popular, gold sets the tone for other precious metals. Silver’s recent surge is owed in large part to the yellow metal’s record-smashing boom. Gold’s performance has paved the way for silver which tends to mirror its growth, albeit in more dramatic moves.

Industrial Demand – Silver only follows oil as the most widely used commodity. It boasts over 10,000 applications with many landing in the clean energy sector. Growing efforts to improve energy efficiency and sustainability are expected to drastically increase silver demand. In fact, solar energy is projected to account for nearly 100% of the current annual silver supply.

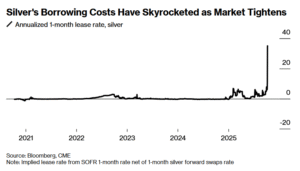

Supply Shortage – An anticipated supply shortage could be another windfall to silver prices. In 2023, the market was smacked with a 15% deficit which is expected to continue into 2024 and beyond. This discrepancy between rising demand and dropping supply often results in higher evaluations as buyers bid over limited availability.

What’s Next for Silver Prices

With silver standing at relative highs, many wonder if the rally is over. In reality, market analysts are suggesting the exact opposite. Amelia Xiao Fu, BOCI’s head of commodity markets, predicts that “Silver is going to continue to rally over the coming quarters.” Ole Hansen, head of commodities strategy at Saxo Bank A/S, assumes silver will stretch to $37 in the near future, representing an impressive 12% gain from current levels. Silver’s bullish outlook appears to shine brightly far onto the horizon, meaning more potential gains for investors who take advantage of the opportunity.