The largest private investment bank on the planet is telling investors to consider silver as prices are expected to climb. UBS analysts project the shiny metal will reach $36 to $38 in the long run, reflecting a 16% to 22% jump from current levels. This anticipated spike in silver prices follows a weakening dollar, economic slowdown, and record-setting gold prices.

Gold Sets the Standard

Many investors wonder how silver and gold prices correlate given their similar investment characteristics. While there are key differences in price action, gold tends to set the tone for other precious metals. UBS suggests gold’s recent surge to all-time highs is laying plenty of runway for silver prices.

Weak Economic Outlook Shines on Silver

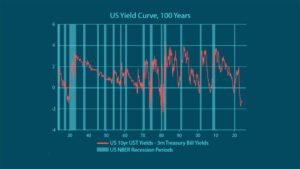

The bleak macroeconomic environment is creating fertile ground for sprouting silver prices. UBS analysts highlight the dollar’s shaky performance and deteriorating domestic markets as the prime drivers behind the increasing risk aversion among investors. The stock market is cooling from recent highs, recent CPI numbers were higher than expected, and the Federal Reserve is launching an aggressive rate cut policy — all conditions contributing to a weaker USD. These shifts are prompting an increase in safe-haven demand which is further boosting precious metals prices. “Historically, the metal has outperformed equities during periods of elevated volatility,” reports UBS analysts.

Industrial Demand Kicks Up

The grim economic outlook isn’t the sole catalyst for silver’s anticipated boom. UBS thinks a long-term rise in industrial demand for the shiny metal will sustain higher prices far down the line. The worldwide transition into greener forms of energy will comprise the majority of new purchases. Although many factors influence silver prices, industrial demand is one of the most influential factors. This steady increase in demand is expected to coincide with a prolonged dip in silver supplies. UBS suggests, “The silver market will remain in deficit over the coming years…which should help fundamentally underpin prices as well as act as a tailwind for investor interest.”

Long-Term Focus

UBS’s analysis of silver price growth emphasizes a long-term outlook. While short-term factors like fluctuating interest rates may give silver a temporary boost, the investment bank points to more fundamental drivers, such as increasing demand from the renewable energy sector, as the primary catalysts for silver’s sustained growth. Investors considering silver should carefully assess their investment horizon, as precious metals typically offer the greatest growth potential when held over an extended period.

Silver as Inflation Hedge

In discussions of precious metals as inflation hedges, gold tends to outshine its counterparts. However, silver as an inflation hedge has a proven track record of keeping pace with rising prices. Silver’s inverse relationship with the broader market makes it a popular choice during periods of economic downturn, offering investors a reliable way to protect their wealth from the eroding effects of inflation. Highlighting the growing focus on precious metals, Scottsdale Bullion & Coin’s (SBC) Precious Metals Advisor Todd Graf points out, “Everybody’s looking at gold and silver as a store of value…a way to protect their purchasing power and money.”

Silver to Outpace Gold

While silver has historically followed gold’s lead, it may soon take center stage. In one of the most assertive forecasts from the report, analysts at UBS “see silver outperforming gold over the next 12 months.” This optimistic projection highlights silver’s potential to outpace its more established counterpart, signaling a strong opportunity for investors in the months ahead. The window of opportunity on relatively low silver prices could be closing.