Russia’s gold reserves have climbed to their highest levels in 25 years, marking a significant milestone in the country’s efforts to bolster economic stability amid an onslaught of international sanctions. In September 2024, the central bank’s gold stockpiles reached 2,335 tons, representing the world’s 5th largest supply of the yellow metal. While Russia has consistently maintained a sizable gold inventory, the past few years have seen heightened demand.

Russia Sheds US Treasuries for Gold

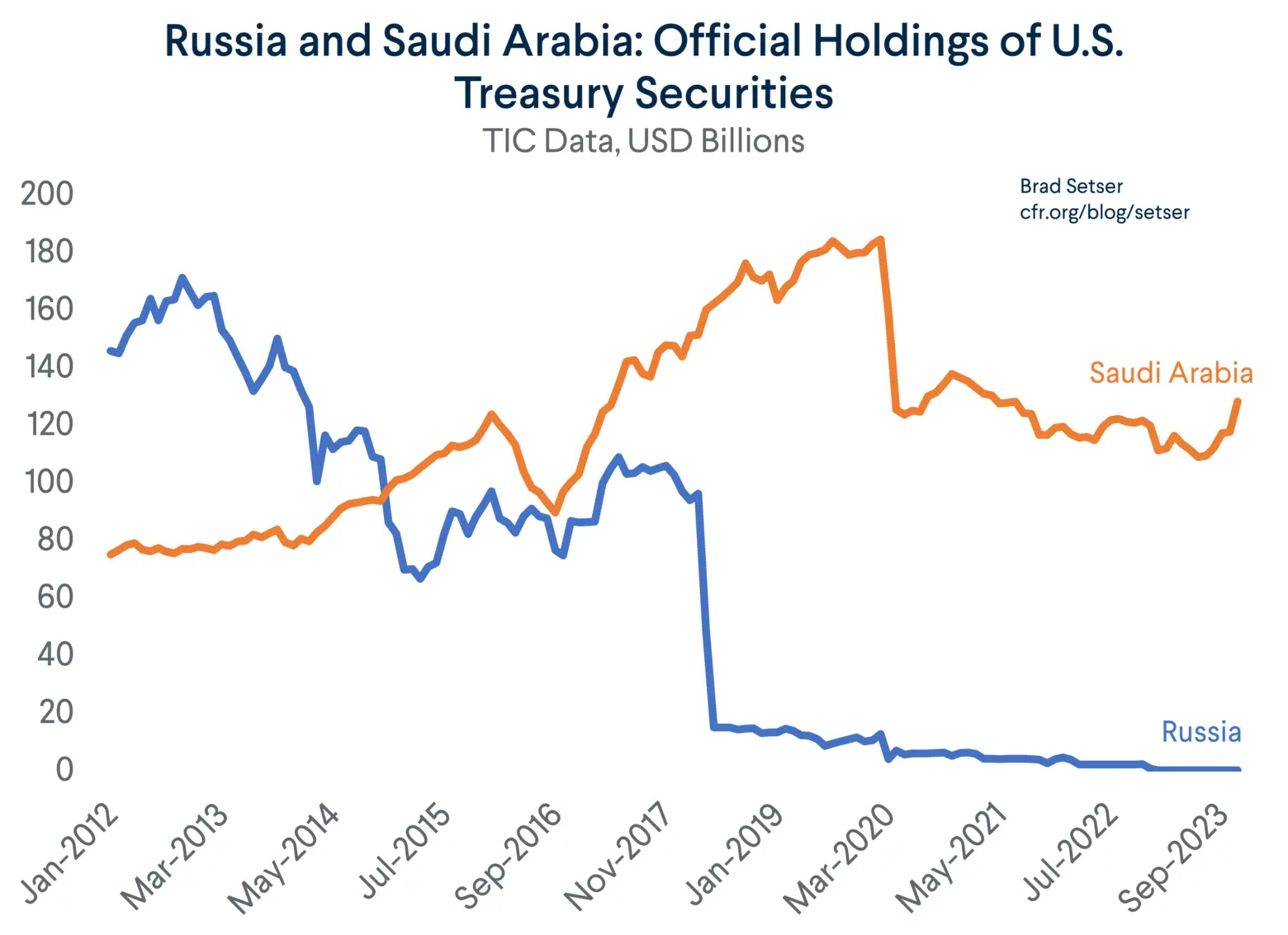

The news of gold reserves hitting a quarter-century high paints only part of the country’s evolving economic landscape. While Russia is actively ramping up gold purchases, it’s shedding US dollars at the same time. Between 2012 and 2022, the value of Russia’s US Treasury holdings plunged from over $140 billion to under $10 billion, representing a staggering 93% decrease. That trend has only escalated since the invasion of Ukraine and the ensuing Western sanctions.

Source: https://www.cfr.org/blog/Setser

In contrast, gold accounts for 30% of the country’s holdings, underscoring the nation’s concerted shift to the yellow metal. Russia’s central bank ramped up purchases in 2022 and 2023 and outperformed most nations in gold demand for the first half of 2024.

Dollar Weakness & Weaponization to Blame

The Russia-Ukraine war might have been the catalyst for the country’s most recent gold-buying spree, but dollar weaponization isn’t the only explanation. Like other countries pursuing de-dollarization, Russia is starting to view USD as more of a risk than it’s worth. The dollar’s weakness stemming from fiscal mismanagement bears part of the blame. A combination of a $35 trillion national debt bubble and the potential for further economic pressure is pushing a major regional economy away from the dollar.

Daily Purchases Up 700%

Recently, the Russian Finance Ministry announced increasing daily gold purchases by 700% — a clear indication of the country’s decisive and long-term economic plan. Russia’s successful strategy in evading international sanctions suggests the country won’t change its aggressive stance on the world stage. This is likely to lead to more dollar-weaponization and, in response, even more gold demand from Russia.

A Greenlight for Emerging Economies

Russia’s successful economic strategy has implications far beyond its borders. As a founding member and de facto leader of BRICS, Russia serves as a model for many emerging economies. Its ability to pivot away from the US dollar and embrace gold demonstrates a viable path for countries looking to reduce dependence on the greenback. This shift signals to other nations that de-dollarization, supported by alternative reserves like gold, is not only possible but potentially beneficial in the current global economic climate.

How Investors Are Impacted

Russia’s shift to gold alone may not significantly impact investors, but the broader implications are profound. This transition reflects growing momentum as central banks worldwide are buying gold at record rates, a trend expected to continue. At the same time, de-dollarization is accelerating, threatening the dollar’s status as the world’s reserve currency. Should this trend lead to a devaluation of the dollar, US investors heavily tied to dollar-backed assets could see significant hits to their portfolios and retirement accounts.

Experts Call for Retail Demand

As central banks pour into gold, many analysts and institutions are calling for retail investors to follow suit. Earlier this month, Bank of America advised investors to buy gold like central banks while Goldman Sachs advised them to go for gold. This consistently indicates a growing shift from traditional, dollar-backed instruments into safe-haven assets such as gold. With experts raising their price predictions, investors could be looking at a closing window of opportunity to lock in prices before the next leg up.