Russia has ramped up its daily gold purchases by a staggering 700%. This surge in demand comes on the back of three consecutive years of record-high purchases. President Vladimir Putin has prioritized strengthening the country’s gold reserves as an onslaught of Western sanctions constricts economic activity. The pariah state is even tapping its oil revenue to pad its gold stockpile, underscoring the push toward economic independence from the dollar.

Russia Gold in Numbers

Russia is buying seven times more gold daily than before.

On a daily basis, the country purchases 8.2 billion rubles ($88.4 million) worth of gold.

The country bought 95 tons in 2023.

Russia led the charge in Q2 2024 buying, adding 3 tons.

Russia holds more than 2,335 tons of gold, the 5th largest in the world.

Liquid Gold for Physical Gold

The Russian Finance Ministry recently announced raising its daily gold acquisitions to 8.2 billion rubles, up from 1.12 billion. This planned increase in gold accumulation comes as the country anticipates windfall energy profits starting in September. Within a month, Russia’s oil export revenue surged from 10.9 billion to 162 billion rubles. This substantial growth in energy income has given Russia the financial capacity to bolster its gold reserves, signaling its commitment to diversifying away from the dollar. Experts expect Russia to keep the spigot open on their oil reserves to further prop up their economy and enhance their ability to stack physical gold.

Strained Relations With the West

After the fall of the Soviet Union, the West attempted to bring Russia into the European fold but Putin’s territorial aggression severely strained relations. The invasion of Ukraine severed ties seemingly beyond repair as Western countries levied crushing sanctions against Russia. In response, the country’s central bank has ramped up gold buying to reinforce the value of the Ruble, increase domestic economic stability, and reduce the impact of sanctions.

Stronger Russia-China Ties

One unintended consequence of Western sanctions against Russia has been the deepening of its relationship with China, another nation familiar with US sanctions. Both countries have made a concerted effort to increase trade in their local currencies, the ruble and renminbi. Recently, they achieved a significant milestone, with over 90% of Russia-China trade now conducted in these currencies. Meanwhile, the People’s Bank of China (PBOC) has accumulated an impressive gold reserve of 2,264 tons and has even implemented gold-buying quotas, reinforcing the shift away from the dollar in favor of alternative strategies for financial security and growth.

Emerging Economies Follow Suit

Together, Russia and China represent the ringleaders of the BRICS nations — a consortium of emerging economies seeking more independence from the dollar. Their relatively successful de-dollarization is expected to encourage other countries to follow suit. In fact, emerging markets are overly represented in central bank gold demand, suggesting more buying as these nations move away from USD.

Why Investors Should Take Note

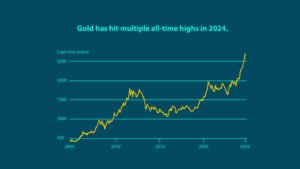

While the impact on everyday investors may not seem obvious at first, Russia’s aggressive gold buying – fueled by excess oil profits – reflects a significant shift in the global economy. Central banks worldwide are purchasing gold at record levels as governments move away from reliance on the dollar.

This trend has driven gold prices to all-time highs and weakened the dollar’s position. Central banks, often viewed as the market’s most strategic and well-informed investors, are leading this charge. In fact, Bank of America recently urged individual investors to buy gold like central banks, reinforcing the importance of this market shift.