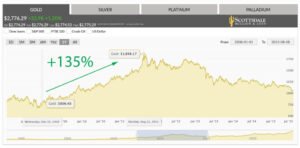

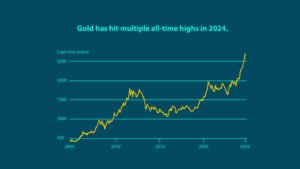

Gold’s Rise Nearing $2,700

Over the past 12 months, gold has experienced a significant rise, with prices climbing nearly 30% year-to-date. Currently hovering around $2,667 per troy ounce, gold is climbing closer to the $2,700 mark. The bar is moving higher and higher. Just a few months ago everyone was asking, “will gold rise past $2,400”. Not long before that the target mark was $2,200. It is time to ask a simple question. Is there an end in sight to gold’s rise? This upward momentum shows no signs of slowing down, and this is because the drives have not slowed down. Gold is driven by a mix of economic uncertainty, geopolitical tensions, and strong demand from central banks.

Key Drivers Behind Gold’s Surge

Economic Uncertainty: Inflation concerns and a weakening U.S. dollar have led investors to seek refuge in gold, a traditional store of value. All you need to do is compare the price of groceries from two years ago to now, and you can see the significant effects of inflation.

Geopolitical Tensions: Conflicts in regions like Gaza and Ukraine have heightened global instability, prompting more investors to turn to gold as a safe haven. With Israel now fighting Hezbollah in Lebanon and Ukraine counter invading Russia, neither conflict seems to be slowing down.

Central Bank Demand: Central banks worldwide are bolstering their gold reserves, reflecting ongoing worries about inflation and economic stability.

Staying the Course with Dollar Cost Averaging

As gold continues its ascent, maintaining a disciplined investment approach is crucial. Dollar cost averaging (DCA) remains a smart strategy, allowing investors to mitigate market volatility and build wealth over time. If you have been dollar cost averaging over the last few years, you have seen significant growth in the value of your precious metals. By regularly investing a fixed amount, you can take advantage of gold’s upward trend while managing risk effectively.

The post Gold’s Rise Nearing $2,700 appeared first on Fisher Precious Metals.