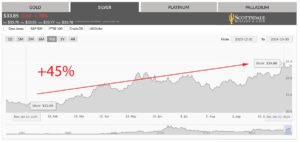

Goldman Sachs recently raised its gold price forecast to $2,900, with a target date in early 2025. This marks the second time in 2024 that the global investment bank has increased its prediction for the yellow metal. The previous target was $2,700, reflecting more than a 7% boost in expected performance. This optimistic outlook aligns with other experts raising their projections, driven by sustained central bank demand, strong ETF fund flows, and gold’s role as a hedge against economic uncertainty.

Price Forecast Breakdown

Recently, Goldman Sachs – the 2nd largest bank by revenue – announced a significant uptick in its gold price estimates. More specifically, the group upped its expectations by $200/oz resulting in a $2,900 forecast. This is expected to materialize by early 2025, likely in the first or second quarter. In terms of average gold price predictions, Goldman Sachs has adjusted its outlook from $2,357 to $2,395 for 2024 and from $2,686 to $2,973 for 2025.

What’s Driving the Surge?

In the report, Goldman Sachs analysts highlighted a handful of key economic factors behind its increased gold expectations. “We reiterate our long gold recommendation due to the gradual boost from lower global interest rates, structurally higher central bank demand and gold’s hedging benefits against geopolitical, financial, and recessionary risks.” Here’s a quick breakdown of the main drivers of gold’s anticipated surge:

Central Bank Buying – Central bank gold demand will account for around two-thirds of the anticipated price growth, according to Goldman Sachs. Following record-setting buying in 2022 and 2023, governments reached peak demand again in the first half of 2024, indicating sustained buying.

ETF Inflows – The other one-third of expected gains is expected to come from a boom in exchange-traded fund (ETF) flows. In September, gold ETFs counted their fifth straight month of inflows, representing strong retail investment demand. Goldman Sachs sees this trend continuing, pushing the yellow metal higher.

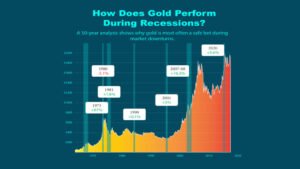

Uncertainty Hedge – Overall, analysts point out gold’s status as a safe-haven asset. Central banks and retail investors continue adding to their stockpiles because gold “offers significant hedging value to portfolios against geopolitical shocks including tariffs, Fed subordination risk, and debt fears,” according to the group.

Gold is a “Highest Confidence Asset”

Goldman Sachs isn’t just emphasizing gold’s record-setting rally and anticipated growth. The investment bank is also highlighting the yellow metal’s comparatively strong performance against the broader market. “Gold stands out as the commodity where we have the highest confidence in near-term upside.” This assertion is supported by the fact that gold is outperforming nearly all other assets, including the stock market and even the tech sector. While the stock market has neared all-time highs, its returns are modest compared to gold, which is closing in on a 30% gain.

Experts Rally Behind Higher Gold Prices

Goldman Sachs isn’t the first, and most likely won’t be the last, expert to revise their gold price predictions to the upside. Several major banks, financial institutions, economists, and precious metals advisors have called for higher gold prices amid deteriorating conditions and widespread uncertainty. For example, Citibank and Bank of America have upped their forecast to $3,000!

Goldman Sachs Says “Go for Gold”

A few weeks ago, Goldman Sachs encouraged investors to “go for gold,” signaling its optimistic outlook. The bank has since reinforced this stance by raising its price prediction, further underscoring its bullish view on the metal. Despite gold hovering near all-time highs, there’s widespread consensus that the rally is far from over. Investors may be facing a shrinking window to increase their gold holdings before prices surge once again.