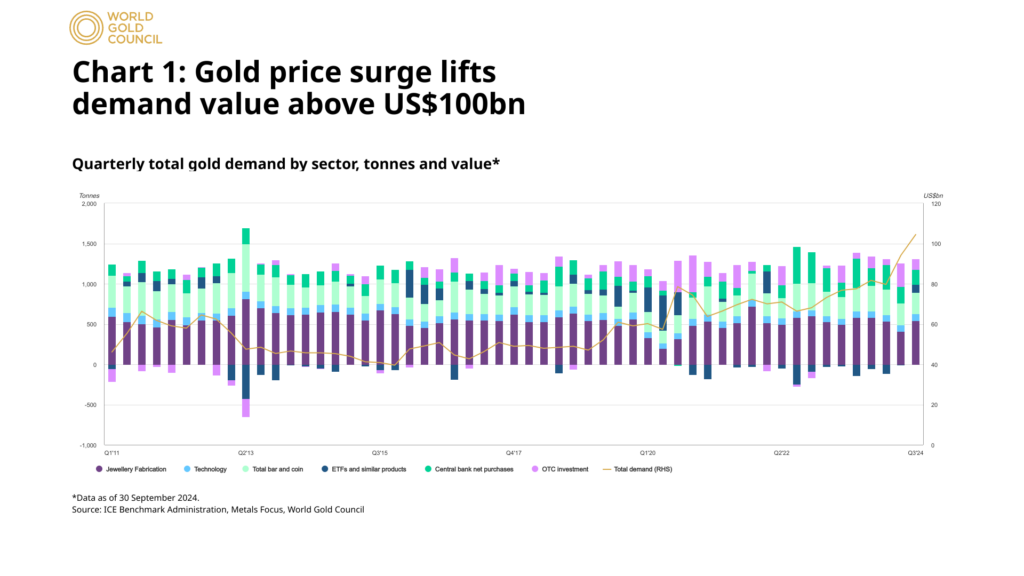

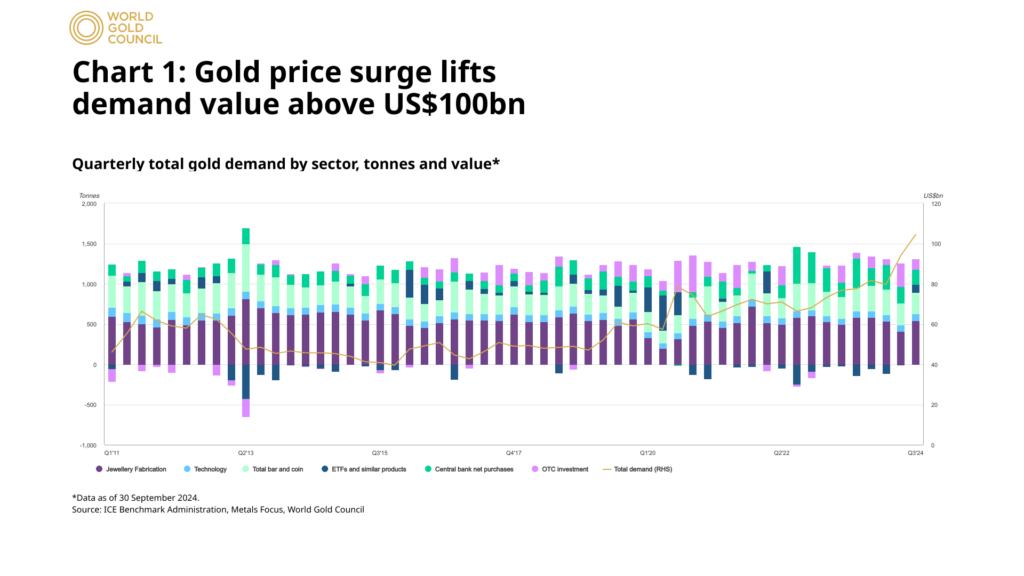

The overall value of gold demand surged 35% year over year in the third quarter of 2024. In total, investors poured $100 billion into the precious metal. According to a World Gold Council (WGC) report, this jump in gold appetite marks a fresh Q3 record. Analysts highlight how booming demand is reflected in gold’s explosive rally with the yellow metal up over $700 since the beginning of the year.

Q3 2024 Gold Demand

Through July, August, and September of 2024, total gold demand reached 186.2 tons. This is slightly down from Q1 and Q2 purchases which reached 305.2 tons and 202.2 tons, respectively. However, this demand still notched a historic record for Q3, a historically low quarter for gold buying. On a year-to-year basis, the total demand for the yellow metal notched 1,313 tons.

Gold Demand By Source

Gold interest rose across the board, with both paper and physical gold seeing an uptick in purchases from private and public investors alike.

Central Banks — Following record-setting gold buying in 2022, 2023, and the first half of 2024, national-level buying slowed slightly as governments scooped up 186.2 tonnes in Q3. Despite the minor dip, year-to-date purchases remain on pace with 2022.

Gold ETF Inflows — One of the most valuable contributors to gold’s growth in demand value this quarter was gold exchange-traded funds (ETFs). These paper gold assets received 95 tons worth of inflows marking the first net positive quarter since the beginning of 2022.

Jewelry Consumption — While jewelry demand by weight dropped by 12%, the amount investors spent reached $36 billion — a 12% year-over-year surge. Even with a dip, raw consumption sustained an impressive 459 tons since Q3 of 2023.

Artificial Intelligence (AI) Technology — The rapidly growing field of AI is requiring more and more gold. Demand from this sector rose 7% in Q3 but with a relatively low starting point.

Supply Strains

Robust demand isn’t the only variable fueling gold’s rise. The supply side of the equation is also shedding a bullish light on the yellow metal’s future. Total gold supplies jumped 5%, and mining production achieved a 6% increase in the last year. However, newly available gold fell short of gold purchases, highlighting the growing imbalance between supply and demand. Earlier this year, the WGC warned that gold is getting harder to find as the cost-efficiency of mines decreases and government red tape increases. With demand on track to rise and supplies waning, investors will end up outbidding each other, further driving gold prices.

Factors Shaping Q4 & Beyond

The WGC has a bullish outlook on gold for the rest of 2024 and beyond. The leading gold authority highlighted some specific expectations leading into Q4 and through 2025.

Higher Gold Prices – Gold prices are expected to continue rising despite climbing to new highs several times in Q3. In fact, a WGC representative recently said the yellow metal could reach $3,000. This comes as many experts raise their gold price predictions for a second time in 2024.

Fresh Investor Interest – WGC expects gold’s impressive year-to-date returns and increased media coverage to generate interest among new investors. The resulting waves of new purchases are expected to further buoy gold prices.

Political & Geopolitical Tensions – The combination of deepening political divides in the lead-up to the presidential election and worsening geopolitical conflicts abroad will continue driving safe-haven demand, encouraging more investors to protect their wealth with gold.

Global Interest Rate Cuts – The Federal Reserve’s decision to dramatically cut interest rates is reflected in fiscal decisions across the globe. This worldwide shift into quantitative easing lowers the opportunity cost of owning gold which makes it a more attractive asset, according to WGC.