Gold delivered a record-setting year in 2025 across virtually every major dimension of the market. Demand volumes, market value, investment flows, and pricing all reached historic levels, marking one of the most consequential years for gold in modern market history.

Gold delivered a record-setting year in 2025 across virtually every major dimension of the market. Demand volumes, market value, investment flows, and pricing all reached historic levels, marking one of the most consequential years for gold in modern market history.

Rather than being driven by a single source of demand or a discrete catalyst, gold’s performance reflected its increasingly central role within a changing global economic landscape, where financial stability, diversification, and systemic risk management have become dominant considerations.

A Record Year Across Every Layer of the Gold Market

The World Gold Council released the gold’s demand trends and data for 2025, revealing a historic year for the yellow metal. The market’s landscape was characterized by a rare concentration of records and structural milestones across multiple layers.

Demand Records That Redefined the Market

Global gold demand reached an all-time high of 5,002.30 in 2025. Worldwide gold exchange-traded funds (ETFs) exploded, with net inflows of 801.2 tonnes, a rapid turnaround from net outflows of 2.9 tonnes in 2024. 2025 marked the second-largest annual ETF inflow year on record.

Demand for gold bars and coins achieved a 12-year high of 1,374.1 tonnes, up 16% from the prior year. Investment demand overall climbed a whopping 84%, stretching to 2,175.3 tonnes. This represents the largest yearly growth rate in modern gold market history.

Central banks, which have been the single largest influence on gold demand in recent years, continued adding to reserves at a historically elevated pace. In total, official purchases reached 863.3 tonnes, down 21% from 1,092.4 tonnes in 2024, yet still among the highest annual levels seen this century.

A Year of Unprecedented Price Strength

Throughout 2025, gold established a record of 53 new all-time highs — the most within a calendar year in history. Furthermore, the yellow metal maintained the highest annual average gold price ever recorded, sticking around $3,431/oz over the course of the year, up a stunning 44% from the prior year.

Gold’s strength was even more impressive on a quarterly basis. In Q4 2025, prices achieved the highest quarterly average gold price ever at $4,135/oz, surging 55% year-over-year when Q4 2024’s average price was $2,663/oz. The total global gold market reached an unprecedented $555 billion in value, up 45% year over year, the highest ever recorded.

Jewellery: More Dollars, Fewer Ounces

Despite lower physical volumes, global jewellery demand reached an all-time high in value, with nominal spending rising 18% year over year. This means consumers collectively spent more money on gold jewellery than ever before, largely because higher gold prices increased the cost of each purchase.

At the same time, jewellery consumption by weight fell to 1,542.3 tonnes from 1,886.9 tonnes in 2024 — an 18% year-over-year drop. In simple terms, people bought less gold in grams and Troy ounces, but paid more for what they did buy. The gap between these two figures highlights how demand in monetary terms strengthened, while demand in physical terms contracted.

Supply Under Strain, Not Yet in Shortfall

Total gold supply was neck and neck with demand, even amid records across multiple demand categories, pointing to an increasingly strained market — not yet in outright shortfall, but clearly flirting with it. This pressure emerged even as global mine production reached a record 3,671.6 tonnes, up only 1% from the prior year.

Recycling added 1,404.3 tonnes, up 3% from the prior year — a modest response given a roughly 67% rise in prices. Historically, such moves trigger heavy selling, yet many holders retained metal, reflecting limited economic distress and expectations of further appreciation, keeping supply growth structurally constrained.

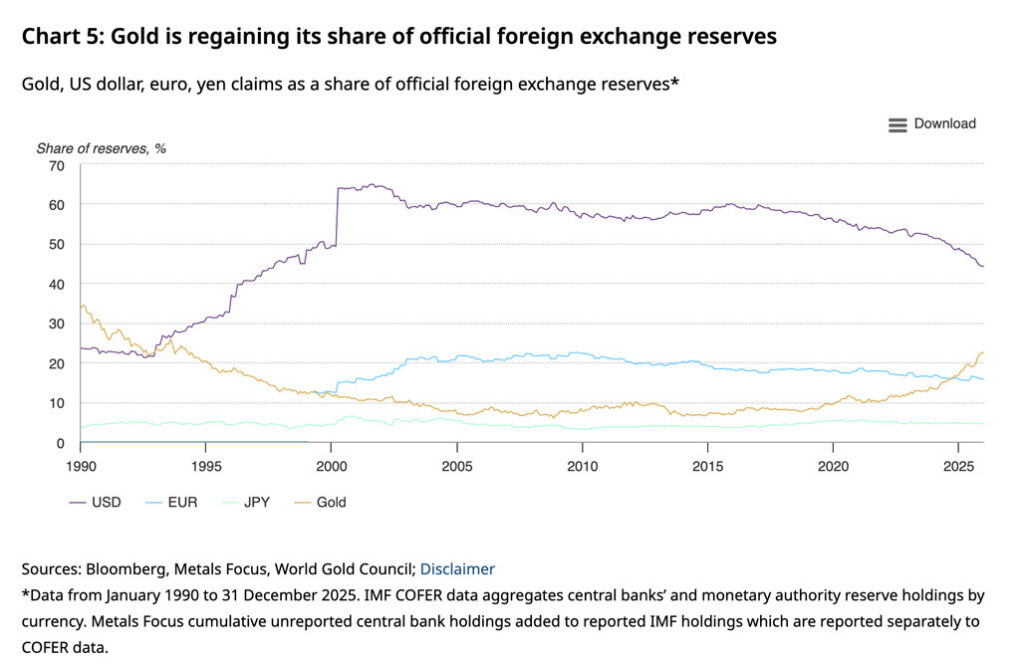

A Rising Share of Global Foreign Exchange Reserves

Beyond annual purchase volumes, one of the more structurally significant developments in the gold market has been gold’s growing share of global foreign exchange reserves. Over the past few years, a global de-dollarization trend has seen foreign investments slip from USD-anchored assets, diverting into physical gold.

Source: WGC

WGC analysts report that gold holdings as a proportion of official reserves are now approaching levels last seen in the early 1990s. This comes shortly after the yellow metal overtook the euro to become the second-most widely held asset by official investors. Meanwhile, the dollar’s share has fallen to its lowest point in a quarter of a century.

Gold’s Reserve Value Overtakes Treasuries

In terms of raw dollar value, gold has surpassed U.S. Treasuries within official reserve holdings, as rising gold prices and softer government bond performance have shifted relative market weights. However, this comparison reflects valuation changes rather than a replacement of Treasuries’ core liquidity role in reserve management.

Market Outlook: The Road Through 2026

As we move deeper into 2026, the momentum from a historic 2025 appears far from exhausted, though the market is entering a phase of higher volatility and strategic re-balancing. Most major financial institutions maintain a strong bullish stance, with gold price targets for year-end 2026 currently averaging $5,800 per ounce. This continued ascent is expected to be underpinned by a “structural shift” in demand, as central banks are projected to purchase another 800 tonnes this year to further diversify away from the U.S. dollar.

Silver is positioned to potentially outpace gold in percentage terms, with aggressive forecasts for silver prices in 2026 suggesting it could challenge $106 per ounce. This “white metal” rally is being fueled by a dual-engine of record industrial demand—particularly from the solar and EV sectors—and a persistent multi-year supply deficit. While tactical pullbacks are likely as investors digest recent gains, the combination of geopolitical risk, sovereign debt concerns, and a shifting global monetary landscape suggests that the “debasement trade” remains the dominant theme for the year ahead.