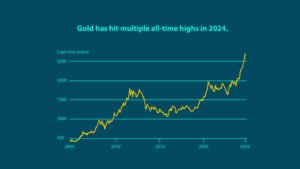

Gold is barreling toward the milestone of $3,000/oz, following six months of record highs. Many experts anticipate the yellow metal will reach this threshold by 2025. So far, gold has stretched 27% in 2024, outperforming the broader stock market. With gold prices confidently hovering near $2,700, the path to the $3,000 mark seems imminent. A convergence of economic, geopolitical, and domestic factors, at home and abroad, is driving gold prices even higher, despite the metal already reaching record levels.

Gold Shines Brighter

Not long ago, a $3,000 gold spot price seemed out of reach. However, a mix of worse-than-expected economic data and surging gold demand has propelled prices beyond what most analysts thought possible in such a short time. In fact, many experts are already raising their price forecasts, even following an impressive rally.

Even traditionally bearish financial institutions are forecasting gold to break this psychological barrier within the next year. The shift in sentiment highlights how rapidly changing economic conditions and gold’s safe-haven appeal have rewritten expectations for the precious metal.

Citibank sees gold hitting $3,000 by mid-2025.

Bank of America expects this all-time high by 2025.

Gareth Soloway calls for $3,000 in the next 12-18 months.

Bloomberg Intelligence has its sights set on the $ 3,000 mark too.

Key Forces Driving Gold Surge

Central Bank Buying — As the world’s most knowledgeable and wealthiest investors, central banks set the tone for demand and prices. Governments have maintained record-breaking gold demand for several consecutive years, setting a recent all-time high in the first half of 2024. This consistent demand drives prices higher and encourages retail demand.

Safe-Haven Demand — Recently, the World Gold Council reported that gold-backed exchange-traded funds (ETFs) notched their fourth straight month of inflows. These popular forms of paper gold suggest retail demand is ramping up. It’s common for gold purchases from everyday investors to trail that of central banks.

Interest Rate Cuts — The Federal Reserve launched a period of monetary easing with a decisive half-point rate cut. Typically, this low-interest-rate cycle is bullish for gold prices as safe-haven demand increases. Investors tend to offload a portion of dollar-linked assets in exchange for more stable instruments as yields drop.

Geopolitical Tensions — The unpredictable nature of geopolitical tensions has escalated dramatically, with two wars on the brink of expanding into regional conflicts. These crises not only undermine investor confidence but also disrupt global trade, weaken diplomatic ties, and slow economic growth. As uncertainty looms, more investors are turning to gold to shield themselves from the financial fallout of war.

Economic Destabilization — The world economy is undergoing a momentous shift as the dollar’s status as world reserve currency is increasingly under threat. Financial mismanagement at home and de-dollarization efforts from abroad are driving down demand for the dollar. In lieu of a strong reserve currency, countries are opting for physical gold.

The Bottom Line: Gold Aims Higher

Nearly everyone from Wall Street analysts and economists to major banks and financial institutions is calling for higher gold prices. Investors who aren’t adding to their stockpiles now run the risk of buying gold at higher prices down the line, reducing their total returns. This bullish chorus is informed by various economic and geopolitical factors that create fortuitous conditions for gold growth.