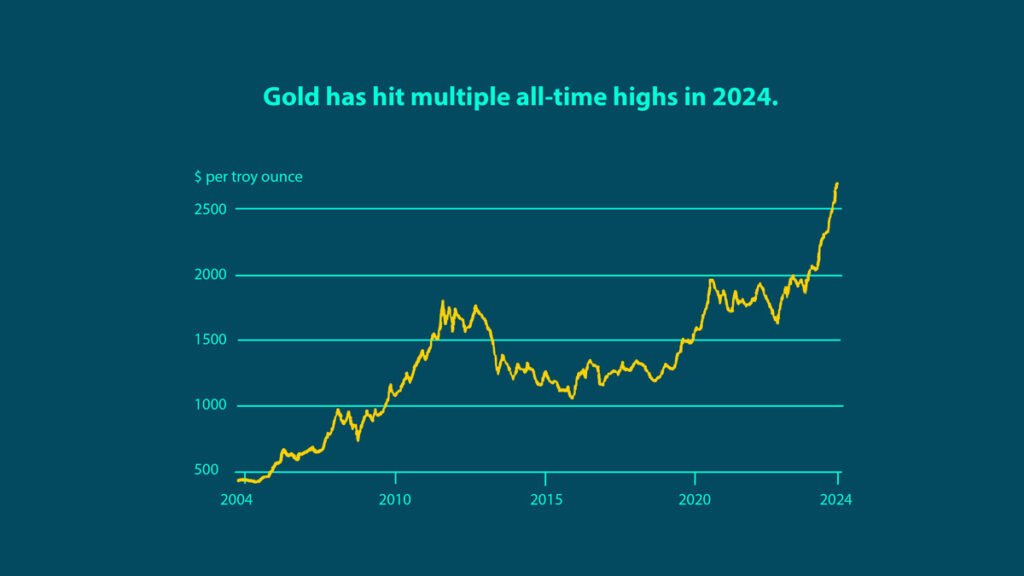

Gold’s rally remains unchecked as prices reach well beyond the $2,700 an ounce mark. This recent jump pushes the precious metal’s yield to more than 33% in 2024 alone. Understanding the backdrop of this surge can help investors better prepare for where gold prices might go in the future.

In this week’s The Gold Spot, Precious Metals Advisors Brian Conneely and Tim Murphy explain how the fundamentals behind gold’s growth haven’t changed, how the precious metals markets are breaking free of manipulation, and where gold and silver prices could go.

Gold’s Fundamentals Stay Strong

Gold keeps making its way into the spotlight as it breaks more records or another expert predicts higher moves in the future. In reality, though, not much has changed fundamentally for the yellow metal. Over the past few months, gold prices have confidently chartered dozens of new highs.

The unprecedented surge has been largely fueled by robust central bank gold demand. Other bullish factors like interest rate cuts, geopolitical tensions, and political turmoil have helped to fan those flames for. Still, the metal’s overall upward momentum is sustained by central banks — the largest buyers in the market. Between 2010 and 2022, national purchases averaged about 550 tons per year. Since then, governments have nearly doubled this average, consuming more than 1,000 tons on average annually.

Gold & Silver Manipulation is Nothing New

Investors have always assumed major players were manipulating the gold and silver market, but the smoking gun wasn’t ever found, until recently. The conviction of two J.P. Morgan commodity traders blew the lid off massive manipulation tactics that had arbitrarily kept gold and silver prices down. What most investors don’t know is these practices date back a quarter century.

The US and England collaborated to overload the market with physical gold to drive the value down. The goal was to make the American and British economies and currencies appear stronger. Eventually, those tactics were picked up by massive financial institutions that sell the paper market to put a lid on prices.

Asian Central Banks Take Advantage

China is always playing the long game when it comes to economic decisions. While most central banks didn’t ramp up their gold buying until recently, the People’s Bank of China (PBOC) was topping up reserves 25 years ago. The country’s leadership foresaw the US dollar’s downward trajectory and decided to shore up the economy and local currency with gold bars and silver bars.

Many other Asian nations followed suit, which is typical with China’s status as a regional influence. Recently, the Eastern Hemisphere’s shift to gold has only escalated. China has implemented gold-buying quotas. For its part, Russia has increased its daily gold purchases by 700%, right before its gold reserves topped 25-year highs.

Supply & Demand Imbalance

As more and more central banks, especially among emerging economies, increased their gold bullion demand, the supply started to run dry. By the time 2022 rolled around, and central bank buying skyrocketed, there wasn’t enough physical gold to go around. Gold prices were shaken awake by this supply and demand imbalance earlier this year. Thus far in 2024, the yellow metal has notched a record-busting 33% increase.

Manipulators Lose Control

The precious metals manipulators are starting to lose their grip on the markets as demand becomes too strong to keep a cap on prices. Gold has already busted through the ceiling major banks had tried to keep on it for years, entering uncharted territory. Silver is a smaller market that is easier to control, but the shiny metal shows signs of a breakout. Silver prices have reached their highest level in 12 years on the back of gold’s rally, and Russia recently added the metal to its reserves.

“The bull market we’re now in for gold and silver is going to last much longer and go much higher than anybody could imagine.”

Gold & Silver Set Up for ‘Epic’ Surge

The economic climate today is eerily similar to that of the 1970s: inflation is hanging around, the economy shows signs of slowing, and the job market isn’t as robust as expected. These combined factors caused the tragic stagflation that ravaged the 1970s economy.

The silver (and gold) lining is that precious metals perform their best in a stagflationary environment. Gold prices soared in the years during and following the disastrous 70s economy. Now is the time to safeguard your assets before the storm hits and prices take off and don’t return.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Questions or Comments?

We do not sell your information.