Central Banks Are Buying Gold

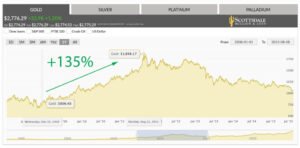

In recent years, central banks worldwide have been buying gold in much larger quantities than in the past. This has potentially negative effects to the US economy, and the dollar. According to the World Gold Council, central banks bought a record 1,081.9 tons of gold in 2022. In 2023, that number was 1,037.4 tons. For context, in 2021, central banks only bought 450.11 tons. 2024 has already shown that it will be no different this year. But what does this mean, and why should you care?

Central banks traditionally hold gold for its stability and value retention. However, the recent surge in purchases indicates a shift in priorities. By boosting gold holdings, central banks aim to reduce their reliance on the U.S. dollar. The dollar has been the dominant global reserve currency. This diversification helps mitigate risks associated with dollar-denominated assets. In other words, the uptick in gold indicates a move away from the dollar, which will have drastic effects on the US economy.

Gold is also seen as a hedge against inflation and economic instability. With high inflation rates and wars all over the globe, central banks are viewing gold as a reliable store of value. Gold is also significantly less susceptible to monetary policy changes than fiat currencies. Additionally, growing concerns about the long-term strength of the U.S. dollar, driven by factors like the rising U.S. national debt and the worsening political climate, motivate these gold purchases. Central banks are preparing for potential declines in the dollar’s value by securing a stable asset.

This trend also aligns with a broader move towards de-dollarization, as countries like Russia and China seek alternatives to the dollar for international trade and reserves. The increased gold reserves signal a cautious outlook on the dollar’s future and suggest a shift towards a more multipolar currency system.

In summary, central banks’ gold stockpiling reflects a strategy of reduced reliance on the U.S. dollar. If the banks are moving some of their holdings to gold instead of the dollar, maybe you should as well.

The post Central Banks Are Buying Gold appeared first on Fisher Precious Metals.