There’s been broad escalation both domestically and internationally with supply chain disruptions, fallout from natural disasters, and intensifying wars. These events will have far-reaching consequences for investors. Those who prepare now will be in a better position to weather the inevitable storm.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Precious Metals Advisor Joe Elkjer and Precious Metals Advisor Todd Graf discuss the implications of closed ports and hurricane damage among other recent events, and why physical gold and silver are the safe-haven assets your portfolio must hold right now.

Supply Chain Vulnerabilities

Earlier this week, U.S. dockworkers across the East Coast went on strike, causing over a dozen key ports to close. The Atlantic coast is a major hub for imports and exports, compounding the economic implications of the shutdown. Some experts predict the closure will cost upwards of $5 billion per day. This widespread walkout couldn’t have come at a worse time as the US economy struggles to recover after an aggressive rate cut blow. It also highlights the vulnerability of US supply chains, an open wound from the pandemic era that had yet to be closed up.

UPDATE: As of Thursday evening, news broke of a tentative deal pausing the strike and extending the existing contract through Jan. 15 to provide time to negotiate a new contract.

Middle East Flares Up

Over the past week, tensions in the Middle East have risen to their most alarming levels in recent memory. Israel launched an offensive into neighboring Lebanon to fight Hezbollah which prompted a missile barrage from Iran. Some people claim that the conflict has already developed into a regional war, but nearly everyone agrees the next moves are decisive in determining the war’s scale.

Hurricane Helene Wreaks Havoc

On the home front, Hurricane Helene has left a path of destruction in its wake. At its largest, the storm stretched over 500 miles, affecting broad swathes of the southern United States and sadly claiming nearly 200 lives. The economic devastation is extensive with some experts predicting Helene to be the most expensive hurricane in the country’s history. Everything from semiconductor chip manufacturing to agricultural production has been severely impacted.

Presidential Election Escalation

Unfortunately, the upcoming presidential election is likely to bring further turmoil and disruption instead of much-needed calm. The deepening political divide is leading to more partisanship than solutions for the problems of everyday Americans.

Now Is the Time to Prepare

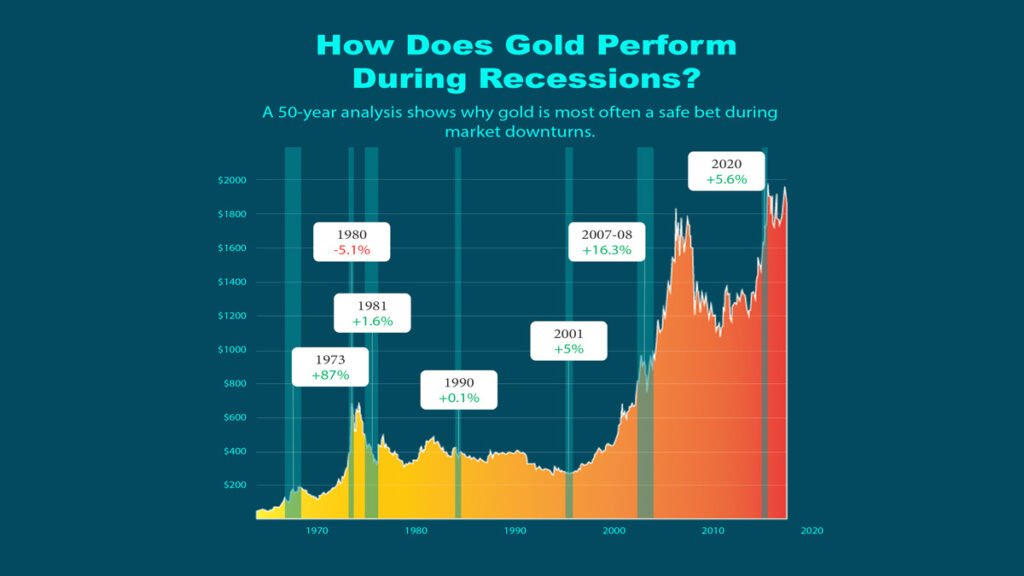

As economic struggles and geopolitical strife escalate, gold prices continue surging to new highs. The yellow metal has a tendency to keep pace with inflation, making it a popular option among investors during periods of financial uncertainty. Throughout nearly all past recessions, physical gold has preserved and even added to its value.

A 50-year chart analysis showing why gold is most often a safe bet during market downturns.

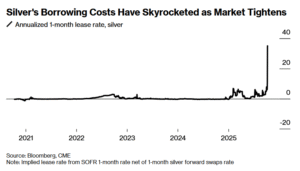

At the same time, silver prices are bullish with the clean-energy boom and safe-haven rush expected to boost silver demand.

“Physical gold and silver in your possession are going to be the safest assets to hold when there’s uncertainty.”

Now is the time to protect your portfolio. The negative pressures harming the economy and propping up gold are only going to increase in severity. Using silver and gold as wealth insurance can ensure your hard-earned nest egg and portfolio remains strong. If you’re interested in learning more about shoring up your financial well-being with physical gold and silver, request your FREE COPY of our Investment Grade Coins report.

Get more out of your gold & silver investments. Read our free, data-backed investment report now.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Questions or Comments?

We do not sell your information.